boosts machine learning model performance

Guardora VFL leverages federated learning technology to enhance ML model accuracy by training on previously inaccessible external data — without the data ever leaving its owner's secure perimeter.

By implementing Guardora VFL, businesses increase revenue through more powerful predictive models.

The solution specializes in tabular data processing.

Explore the Guardora VFL API documentation for implementation details.

A fragment of Swagger UI with Guardora VFL API:

node

get

/node

Get Node Info

post

/node

Post Node

delete

/node

Delete Node

get

/node/public_key

Generate Node Public Key

post

/node/start

Start

post

/node/stop

Stop

remotes

get

/remotes

List Remotes

post

/remotes

Add Remote

delete

/remotes/{remote_name}

Remove Remote

get

/remotes/{remote_name}/check_connection

Check Connection

projects

post

/projects/{project_name}

Create

Delivery format

Access to the repository

How to install

On each participating party perform the following steps:

Intuitive REST API

Use the product’s friendly API to perform model training and inference. Or integrate it into your ML-pipeline

Who plays?

You test solo or with partners

Data

Your data, as well as data from your partners. We can provide our test data

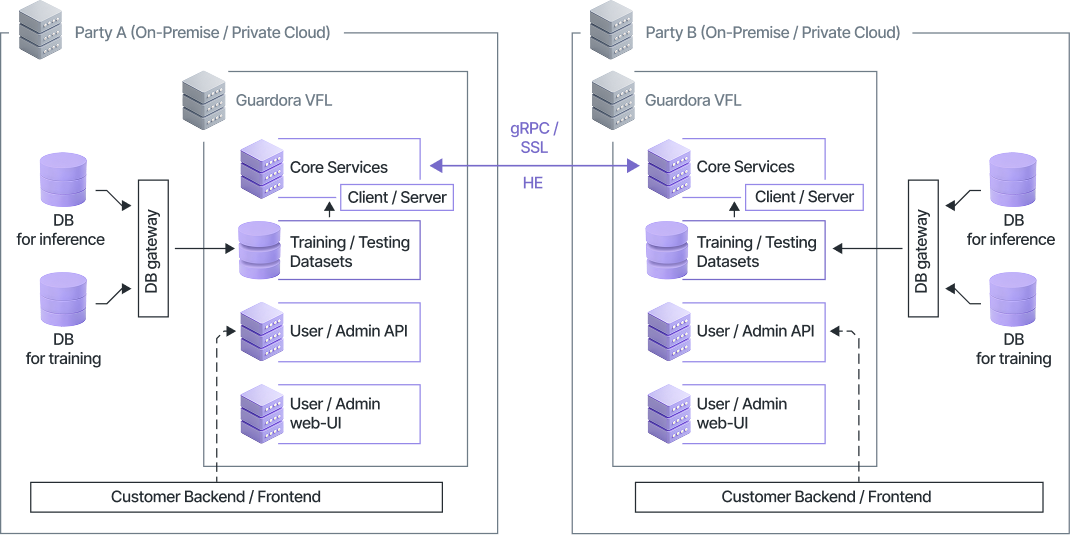

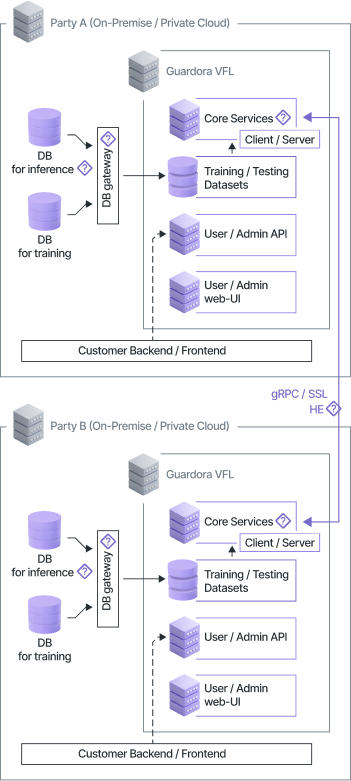

Infrastructure and Security

On-premise or private cloud.

The client itself establishes the necessary security level, and obtains full control over data and processes

Scalability

Scalability within the client's internal infrastructure

Pricing

“Pay-As-You-Infer” licensing model with postpayment - monthly licensing fee based on the number of useful requests (received predictions from federatively trained model)

Support

Guardora’s support is included in the license fee

Dataset synchronization (Private Set Intersection, PSI), training, validation, inference (with homomorphic encryption)

Dataset synchronization (Private Set Intersection, PSI), training, validation, inference (with homomorphic encryption)

Method of obtaining the data table (e.g., CSV file, SQL connection to a database). Implemented by the client

Homomorphic encryption

Method of obtaining the data table (e.g., CSV file, SQL connection to a database). Implemented by the client

Required for high-load inference >300 RPS

Required for high-load inference >300 RPS

Dataset synchronization (Private Set Intersection, PSI), training, validation, inference (with homomorphic encryption)

Dataset synchronization (Private Set Intersection, PSI), training, validation, inference (with homomorphic encryption)

Method of obtaining the data table (e.g., CSV file, SQL connection to a database). Implemented by the client

Method of obtaining the data table (e.g., CSV file, SQL connection to a database). Implemented by the client

Homomorphic encryption

Required for high-load inference >300 RPS

Required for high-load inference >300 RPS

Credit bureaus, Scoring providers, Banks and microfinance organizations, Insurance companies, Payment systems, Telecom operators

Developing new products that require combining data from several companies

Scoring providers, Fintech companies

Overcoming internal barriers to data exchange between companies within a group

Creating unified models for the entire group

Fintech holdings, Groups of companies, including cross-border

Rapid testing of hypotheses on real data of potential clients

Demonstration of the value of the product without the risk of data leakage

Scoring providers, Providers of solutions for working with personal data

Guardora VFL allows training ML models on data from multiple companies while preserving the confidentiality of each company's data. Using a credit scoring model as an example, this means that:

With a better model the client company receives additional revenue through more accurate customer segmentation, reduced defaults, and optimized credit decisions.

Based on the described effect, Guardora offers a transactional “Pay-As-You-Infer” licensing model with postpayment with the following parameters:

Reduction in overdue debt level and increase in lending volume through more accurate scoring

Credit portfolio optimization and increased profitability through improved risk management

Improved underwriting decisions through accurate risk calculation

Increased number of requests and higher product value due to improved scoring model accuracy

To test the demo version of the product and find out the pricing conditions, fill out the form and we will contact you